-

Posted By Editorial Staff

-

-

Comments 0

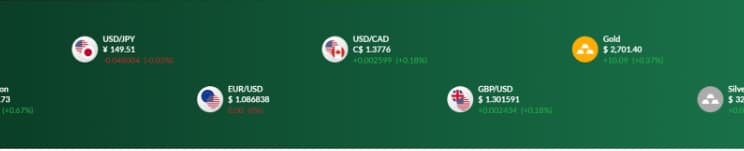

This StanfordMarkets.com review examines how advanced trading tools and competitive pricing give traders an edge in today’s markets. With customizable charts, real-time data, and detailed market analysis, the platform equips users with the insights necessary to react quickly to changing conditions. The StanfordMarkets.com review highlights its low spreads and flexible leverage, which enhance profitability across various asset classes.

Stanford Markets’s advanced tools are designed to meet the needs of both new and professional traders. From Forex to stocks and crypto, the platform helps users stay ahead of the curve with constant updates and analytics. Additionally, competitive spreads across different markets allow traders to optimize costs, supporting better returns. The tools and resources provided aim to simplify decision-making and offer transparency, promoting effective trading practices for all users.

Table of Contents

ToggleAdvanced Trading Tools to Sharpen Your Market Edge

Stanford Markets equips traders with an arsenal of advanced tools designed to enhance precision and efficiency in trading. Users can access customizable technical indicators, market analysis reports, and automated trading systems to fine-tune their strategies. These tools enable traders to recognize patterns, predict price movements, and stay ahead of market trends. Advanced calculators also help assess profit and loss projections, optimize position sizing, and monitor margin requirements. With tools integrated directly into the platform, traders benefit from seamless access to insights that sharpen their decision-making process.

By enabling alerts for specific price movements, traders can automate certain aspects of their operations, minimizing missed opportunities. Automated Stanford Markets trading systems allow users to execute predefined strategies without needing to be actively present, offering an advantage in highly volatile markets. Whether trading Forex, stocks, or cryptocurrencies, the combination of automation and technical analysis tools ensures traders are always positioned to respond effectively to market conditions. These resources cater to both short-term opportunities and long-term strategies, giving users a competitive edge across all market environments.

Customize Your Trading with Charts and Real-Time Analysis

Stanford Markets offers a sophisticated charting system that allows traders to customize their visual analysis of market trends. Users can switch between candlestick, bar, and line charts based on their strategy preferences, adjusting timeframes and indicators for deeper insights. With technical tools like moving averages, Bollinger Bands, and Fibonacci retracements available, traders can overlay multiple indicators to develop well-rounded forecasts. This flexibility ensures that every trader, regardless of style or market, can create an analysis framework that aligns with their strategy.

Real-time analysis tools further enhance trading precision by delivering up-to-the-minute data on price changes and market movements. Traders can act swiftly on real-time news or technical signals, making the most of market opportunities. Whether trading during periods of economic announcements or monitoring rapid shifts in crypto markets, the ability to respond instantly provides a critical advantage. By combining advanced charting options with live data feeds, the platform ensures traders are equipped with the insights they need to execute precise and timely trades.

Tight Spreads, Big Gains – Optimizing Costs for Success

Stanford Markets offers some of the tightest spreads in the industry, minimizing trading costs and maximizing profitability. This cost-effective pricing model ensures that traders retain more of their gains by reducing the difference between the bid and ask prices. Lower spreads are particularly valuable for high-frequency traders, who make multiple transactions daily, as cumulative costs remain low. This focus on keeping trading expenses manageable contributes to a more profitable trading experience, especially for those executing short-term trades.

In addition to tight spreads, the Stanford Markets platform also provides transparent pricing across all asset classes. Users can trade Forex, stocks, and commodities without worrying about hidden fees or unexpected charges. This pricing structure promotes long-term profitability, as traders can predict their costs accurately and incorporate them into their strategies.

Flexible Leverage Options for Risk-Taking and Risk-Management

Stanford Markets provides flexible leverage options that allow traders to adjust their risk exposure according to their strategies and market conditions. Beginners can start with conservative leverage to minimize risks, while experienced traders can access higher ratios to maximize their potential returns. This adaptability ensures that users remain in control of their risk levels, regardless of the assets they trade. Leverage offers users the ability to magnify their positions, but with the freedom to scale it up or down, traders can balance both opportunity and risk effectively.

Forex traders can benefit from leverage ratios up to 1:400, providing opportunities to capture small currency fluctuations with large positions. Crypto and stock Stanford Markets traders can also adjust their leverage according to market volatility, helping them manage risks in unpredictable environments. This level of control ensures that users can navigate market conditions safely, whether seeking aggressive gains or focusing on capital preservation.

From Beginners to Experts – Tools for Every Trader’s Journey

Stanford Markets is designed to cater to traders at every stage of their development, from novices learning the basics to professionals refining advanced strategies. Beginners can start with educational resources, such as webinars, tutorials, and eBooks, to build foundational knowledge. As they gain confidence, they can use basic charts and indicators to practice technical analysis, gradually developing a strategy that fits their trading style.

Experienced Stanford Markets traders benefit from more advanced features, including algorithmic trading tools and detailed market analytics. The platform offers access to in-depth data that supports intricate strategies, such as swing trading or scalping. Professionals can also take advantage of customized alerts, advanced chart setups, and automated trading features, allowing them to fine-tune their trades. With continuous education, analytics, and evolving tools, the platform ensures that every trader, regardless of experience, can succeed and progress throughout their trading journey.

Also read about F&O Trading Among New Demat Account Holders

Final Thoughts on the StanfordMarkets.com Review

This StanfordMarkets.com review showcases how the platform’s advanced trading tools and competitive pricing create an edge for both novice and experienced traders. Customizable charts, real-time analysis tools, and technical indicators enable users to develop precise strategies tailored to their trading goals. Automation options also play a significant role in enhancing performance, allowing traders to execute predefined strategies without constant oversight.

Low spreads and transparent pricing add further value by minimizing trading costs and enhancing profitability. This StanfordMarkets.com review emphasizes how the platform offers flexibility through leverage, giving users control over their risk exposure. Whether seeking moderate gains with conservative leverage or higher returns with aggressive strategies, traders benefit from customizable options that align with their experience and goals. The platform’s combination of advanced tools, real-time analysis, and cost-efficient pricing fosters an environment where traders can optimize their performance and grow their portfolios with confidence.

This article is provided solely for informational purposes and should not be interpreted as a recommendation. The author disclaims any responsibility for actions taken by the company during your trading activities. The information presented may not be fully accurate or current. Your trading and financial decisions are your own responsibility, and it is essential not to rely solely on the information provided here. We do not guarantee the accuracy of the information on this platform and disclaim any liability for losses or damages incurred through trading or investing.