-

Posted By Editorial Staff

-

-

Comments 0

If you are an automobile driver in Mineola, Texas, you should look for a reliable insurance plan that aligns with your budget and financial goals. It’s because Mineola is a peaceful city but there is a possibility of road accidents when you are driving on the road.

In such a scenario, the Texas state law requires you to show evidence that you can pay for the damages you have caused in an accident on the roads.

So, it’s important to apply for an insurance policy on your automobile from a reputable auto insurer. Some people think that it might be an easy process to do but it is daunting. However, Otosigna is an insurance company that streamlines your insurance claim process and entertains your requests.

But you should know the details of the insurance policy and the procedure stepwise so you can file an insurance claim and receive it successfully to cover the expenses of vehicle maintenance and liability damages.

So, let’s get started by exploring the various types of auto insurance coverage you can claim with Otosigna.

Table of Contents

ToggleTypes of Auto Insurance Coverage

Otosigna provides the following types of insurance coverage plans for auto drivers in Mineola:

Collision Coverage

Collision coverage is the coverage type where an insurance company covers expenses resulting from the collision of a car in a road accident. It can include repairing a car and its damaged spare parts or replacement of the vehicle and parts.

Comprehensive Coverage

The comprehensive coverage plan covers the damages to your car caused by other incidents instead of car wreckage in a collision. These incidents can include thefts, vandalism, burning with fire, damage from weather conditions, or other instances.

Liability Coverage

This coverage type covers the damages you have caused to others during the car accident. It can include damage to another person’s vehicle, or property, or any bodily harm you may have caused.

Also read: Spartan Capital Securities LLC Broker Jordan Meadow

Steps to Claim Insurance with Otosigna

This guide provides you with helpful information so you can know the entire process of filing a car insurance claim with Otosigna.

Evaluate Your Policy Terms

Before applying for the insurance claim, you should understand the policy terms stated in the contract you have signed with Otosigna. You need to ensure that your company covers expenses for a particular incident. For example, if your car collides, you should know if your policy facilitates compensation for collision-related incidents.

Report the Incident to the Company

If you get involved in an accident, you should immediately contact Otosigna about the incident. You should notify the company officials and explain the incident. You can visit Otosigna’s insurance office or contact their customer support via helpline.

File a Police Report

If you report the incident to the police, it can help you avoid legal consequences resulting from the incident. So, you should register a complaint and get a copy of the report you can provide to your insurer if required.

Provide Complete Documentation

You should provide complete documentation to Otosigna, as the company takes every piece of information from you to understand the extent of damages and expenses in the incident.

These details include contact details of witnesses, witness statements, photographs of car wreckage or other damages in the incident, and reports of medical bills in case of injuries.

The more information you provide to the insurer, it helps the insurer develops a better understanding of the incident and speed up your claim process.

Inform Details About Your Vehicle

You should provide all the details about your car such as its manufacturer, model, mileage, and year of manufacturing.

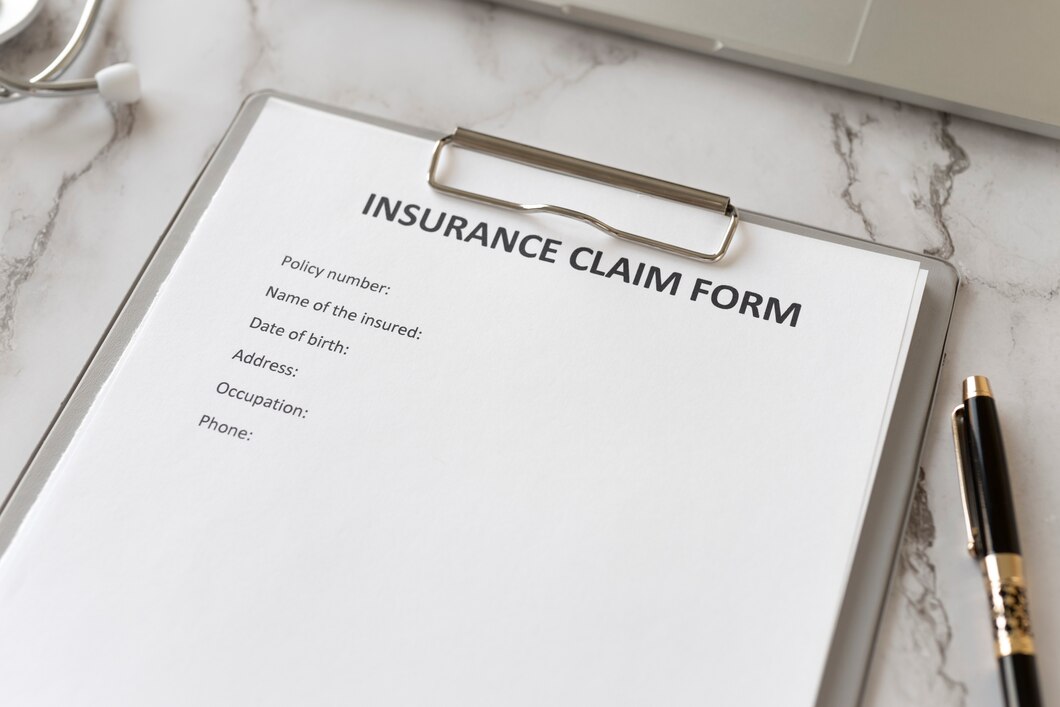

Consult with Your Insurer to Complete Authorization

Once you have provided all the relevant details about the incident and your vehicle to Otosigna, you should ensure that the company authorizes your insurance claim. There are chances that the company will deny your request.

If the company approves it by evaluating the damages and your provided details, the company notifies you about the amount it can cover. The company provides you a claim form which you have to complete to start the process.

Repair Your Vehicle

The company can suggest you an auto repair shop for quality maintenance of your vehicle or request you to provide estimated quotes of the repair expenses. So, you can get your car repaired from the repair shop and pay deductibles if there are any in your policy.

Review and Receive Your Claim

After all the steps have been completed, it’s time to receive the claim from your insurer. But you need to review it to see if all the expenses have been covered according to the agreement and your policy. After reviewing the details, you can receive the settlement to cover your expenses. The insurer can provide you with the amount in the form of a cheque or cash.

Concluding the Discussion

Otosigna is a reliable auto insurance provider that accommodates many drivers operating in the beautiful city of Mineola located in the heart of Texas. It provides due compensation for your expenses and ensures that its clients receive satisfactory services.

You should follow the complete steps properly which include gathering information, documenting details, and reviewing your policy details. You should maintain transparency by providing details and communicating with Otosigna to review how the insurance claim can affect your premiums or deductibles in the future.

An informed decision can provide you with a settlement with the right financial compensation and a sigh of relief from Otosigna.

Also read: How Much is Prednisone Without Insurance?